A Deep Dive on Remitly Global (RELY)

Building a Global Wallet

Contents

Introduction

Company

Moats

Growth

Profitability

Health

Outlook

Valuation

Risks

Thesis

Introduction

As some of my long-term followers are aware, I rarely write about new stocks… but when I do, it’s usually for one reason and one reason only: I like the stock.

More specifically, I like the stock because it fulfills my investment criteria. In other words, the stock has what it takes to be a part of my portfolio, which doesn’t happen often, considering the concentrated nature of my portfolio (I tend to hold 8 to 10 stocks at a time).

But a couple of months ago, I alerted subscribers about a new stock that I’m watching: Remitly Global (RELY).

I did not initiate a position right away, as I wasn’t sure if RELY has a durable competitive moat.

A week after that, RELY reported strong Q2 earnings, which sent the stock 15% higher the next day. However, the gains were short-lived as investors were seemingly not impressed with the new products revealed during its first-ever product launch event.

The recent selloff urged me to take a closer look at RELY.

As I dug deeper into the company, I quickly realized that I might just be staring at a hidden gem — it’s underfollowed, underappreciated, and undervalued.

In my view, RELY is a potential multibagger in the next two to three years.

In this deep dive article, I explain why that is so.

I hope you enjoy this article.

Company

While working in Kenya, Matt Oppenheimer witnessed how troublesome it was for people to send money internationally. People endured long wait times, high fees, unfavorable exchange rates, slow transfers, and uncertainty about whether their money would reach the intended recipients.

Many people have made the tough decision to leave their families behind to work overseas, aiming to provide them with better financial support. For those on the receiving end, remittances — the act of sending money across borders — is essential for their survival.

Surely, there must be a faster, cheaper, and easier way to make these lifeline transfers.

Back in 2010, there was no such thing.

Fortunately, Matt saw this as an opportunity.

He recognized that technological advancements and the widespread use of smartphones could potentially enable people to send money internationally easily and affordably.

Having spearheaded the launch of the first internet banking platform for Barclays Bank Kenya, Matt knew the ins and outs of launching a digital financial platform.

He wasted no time.

In May 2011, Matt left Barclays Kenya and returned to the United States. In that same year, Matt, together with Josh Hug and Shivaas Gulati, co-founded Beamit, a search engine for remittance services.

Not long after, the company shifted its focus to international money transfers.

In April 2012, RELY raised $2.4M from 10 investors, including Eric Schmidt (former CEO of Google) and Jeff Bezos (founder of Amazon).

A few months later, Beamit changed its name to Remitly, which resonated better with its customers — Remitly is a play on the word “remit”.

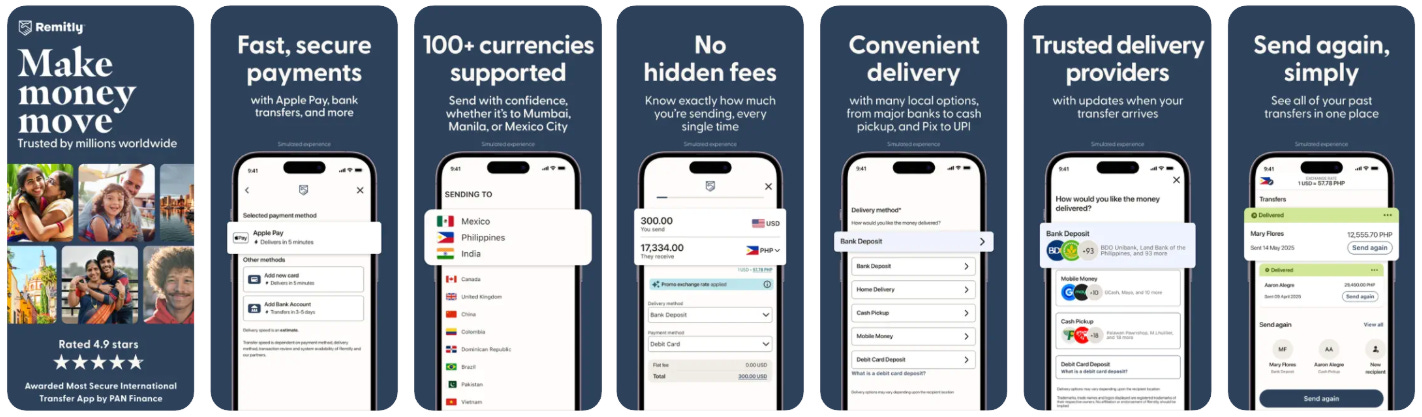

In a nutshell, RELY is a digital remittance company. It offers a cross-border payments mobile app that delivers a fast, reliable, and transparent money movement experience, enabling customers to send and receive funds globally with ease and confidence.

Vision: Transform lives with trusted financial services that transcend borders

As a digital-first platform, RELY eliminates the inefficiencies of traditional methods:

Lower Costs: No physical branches means RELY has substantially lower costs of operations, allowing the company to pass on the savings to customers.

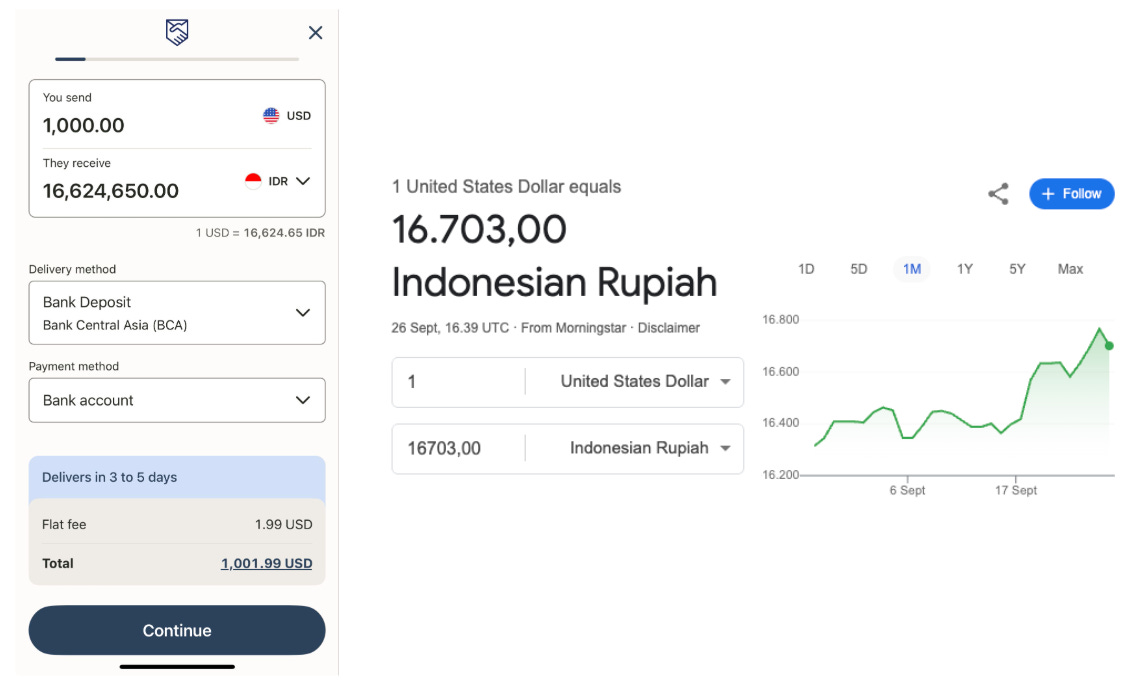

Transparent Pricing: Traditional banks and wire services often charge high transfer fees (5% or more), unfavorable exchange rates, and hidden fees, making the true cost of sending unpredictably high. On the other hand, RELY offers much lower fees (3% or less), better exchange rates, and no hidden charges. Below, you can see the total cost of sending $1,000 to a bank account in Indonesia: $1.99 flat fee with an exchange rate of 16,625 IDR. According to Google, the current USD/IDR spot rate is 16,703 IDR, so the arbitrage on RELY’s platform is just a mere 0.5% (the screenshots were taken within a minute of each other).

Faster Transfers: Transfers via banks or legacy providers can take days to weeks, delaying access to funds needed for urgent expenses. In contrast, RELY can execute transfers instantly via debit/credit cards, and bank account transfers typically take 3 to 5 days. According to management, 93%+ of transactions were dispersed in less than an hour and 95%+ of transactions proceeded without a customer support intervention. Additionally, setting up and sending money with RELY takes just a few minutes.

Digital Experience: Traditional services often involve in-person visits, long wait times, and wasteful paperwork. Let’s not forget the driving, the traffic, the parking. With RELY, all transfers are done through the mobile app, anytime, anywhere.

Real-Time Tracking: Traditional methods often leave senders and recipients unsure about transfer status — they leave customers in the dark. Conversely, RELY offers real-time tracking and text/email notifications. It also clearly displays the expected date and time of delivery.

Flexible Delivery Options: Legacy providers have limited payout methods. They usually offer cash pickup or bank deposits. On the other side, RELY offers various delivery options, including cash pickup, bank deposits, mobile wallet transfers, and even home delivery.

RELY’s superior value proposition over incumbents like Western Union and traditional banks is a no-brainer, which is why the company has grown so rapidly over the last decade or so, gaining the trust of millions of customers in every corner of the globe.

In 2021, RELY went public at nearly a $7B valuation.

Today, it is one of the largest and fastest-growing independent digital remittance providers in the world.

Moats

RELY’s platform is so simple that it’s easy to wonder: How is it any different from other digital remittance providers? Can’t competitors easily replicate its offerings? Does it have a sustainable competitive moat?

When assessing a company’s competitive positioning, I like to refer to Morningstar’s five sources of competitive moats. They are:

Switching costs are obstacles that keep customers from changing between products, like from one company’s product to a competitor’s.

Network effects occur when the value of a good or service increases for both new and existing users as more people use it.

Intangible assets are things such as patents, government licenses, and brand identity that keep a company ahead and competitors at bay.

A company with a cost advantage can produce goods or services at a lower cost, allowing it to undercut its competitors or achieve higher profitability.

Efficient scale benefits companies operating in a market that only supports one or a few competitors, limiting rivalry.

(Morningstar)

In my view, RELY has a wide intangible asset moat and a narrow cost advantage moat.

Intangible Assets (Wide)

Intangible assets are things such as patents, government licenses, and brand identity that keep a company ahead and competitors at bay.

Providing cross-border financial services at scale is incredibly complex and difficult. A company needs to have a vast network of funding and disbursement partners, sophisticated treasury, money transmission licenses, fraud prevention systems, regulatory clearances, and currency exchange management.

Over the last 14 years, RELY has built a robust platform that supports money movement across more than 5,200 corridors, 170 countries, 100 currencies, 470K cash pick up locations, and 5B bank accounts and mobile wallets.

A corridor represents the pairing of a send country, from which a customer can send a remittance, with a specific receive country to which such remittance can be sent.

(RELY 2024 10-K)

RELY’s global payment rails are very difficult to replicate, and as the company continues to expand its rails, the wider its moat becomes.

Because over the last decade, we’ve built this vertically integrated global platform that gives us control at every step. Direct examples like direct integrations with local rails, intelligent routing, to reduce cost and increase speed, embedded compliance and fraud prevention, a global operations network, and the result: a more resilient, capital-efficient, and customer-focused foundation that’s hard to replicate because it takes time to work with all of these global financial services institutions, and do build out the kind of network that we’ve built.

(CEO Matt Oppenheimer — Post-Earnings Webinar with Goldman Sachs on Stablecoins and the Outlook for Cross-Border)

Additionally, RELY’s focus on trust, affordability, and digital experiences has won the company millions of customers, amplifying its brand in the process. Moreover, word-of-mouth within immigrant communities creates a trust-driven network effect, allowing RELY to acquire and retain customers at highly attractive unit economics.

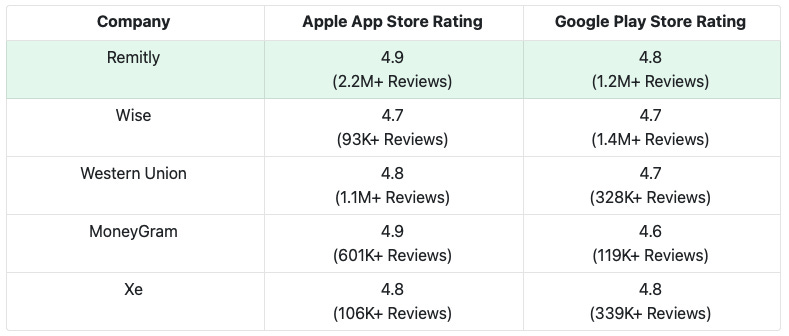

If we look at RELY’s app reviews and compare them with those of competitors, we can see that RELY has the highest rating and most reviews among peers, signifying a brand advantage over them.

With that, as a result of its expansive global payment rails and strong brand presence, I believe RELY has a wide intangible asset moat.

Cost Advantage (Narrow)

A company with a cost advantage can produce goods or services at a lower cost, allowing it to undercut its competitors or achieve higher profitability.

Compared to traditional banks and remittance providers, RELY has a clear cost advantage. Being digitally-native with no physical branches means RELY has a low-cost business model, allowing the company to undercut traditional competitors. More importantly, it allows RELY to pass on the savings to customers in the form of lower prices.

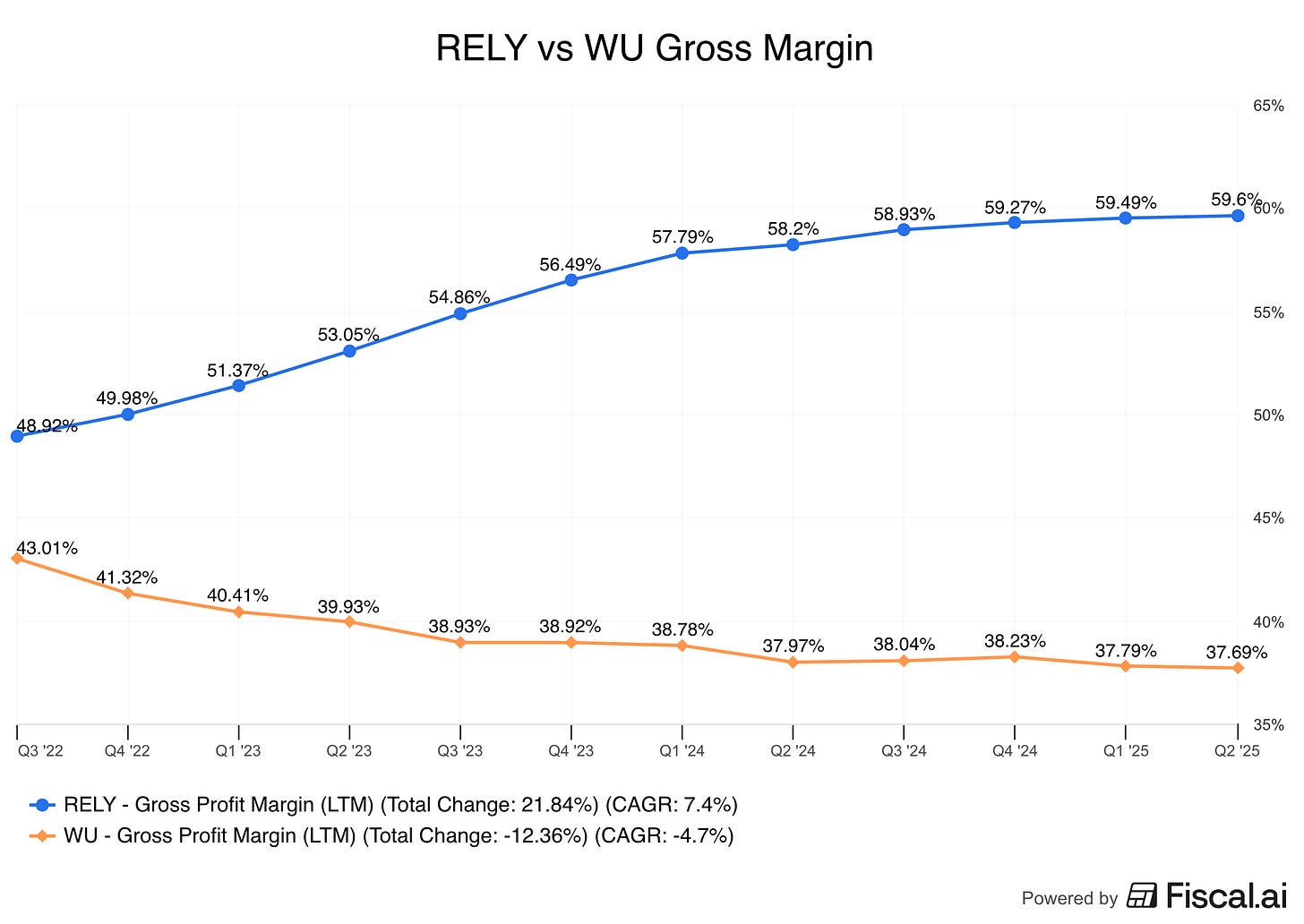

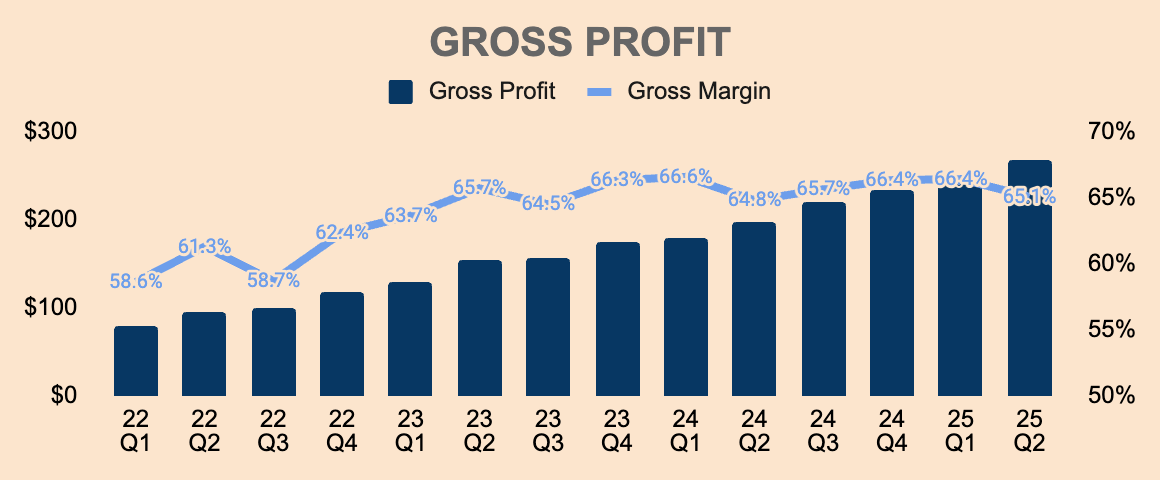

As you can see, RELY has significantly higher Gross Margins than Western Union, reflecting higher earnings power and a cost advantage. What’s more, RELY’s Gross Margin is improving while Western Union’s is declining, displaying the scalability of RELY’s business model and how it is eating into its competitors’ margins.

Having a digital structure also translates to a capital-light, highly-scalable platform, enabling RELY to capture growth opportunities quickly, without having to issue huge amounts of debt.

Leveraging AI and automation could further enhance cost savings, widening RELY’s moat over incumbents.

While I believe RELY’s cost advantage moat over incumbents will allow it to continue taking market share from them, I don’t think it’ll be alone in this industrial shift.

There are other digital remittance providers out there, including Wise, Xe, and Xoom. Moreover, I don’t think it has a cost advantage over its digital peers, which is why RELY remains vulnerable to price competition.

This is why I think RELY has a narrow cost advantage moat.

If it can continue to grow rapidly over the next decade while maintaining or improving its Gross Margin or Take Rate, then I believe RELY has a wide cost advantage.

For now, it remains uncertain if RELY can do this over the long term.

That being said, the combination of RELY’s strong value proposition, as well as intangible assets and cost advantage moats, is disrupting the traditional remittance industry.

This is evident from its rapid growth over the last few years.

Growth

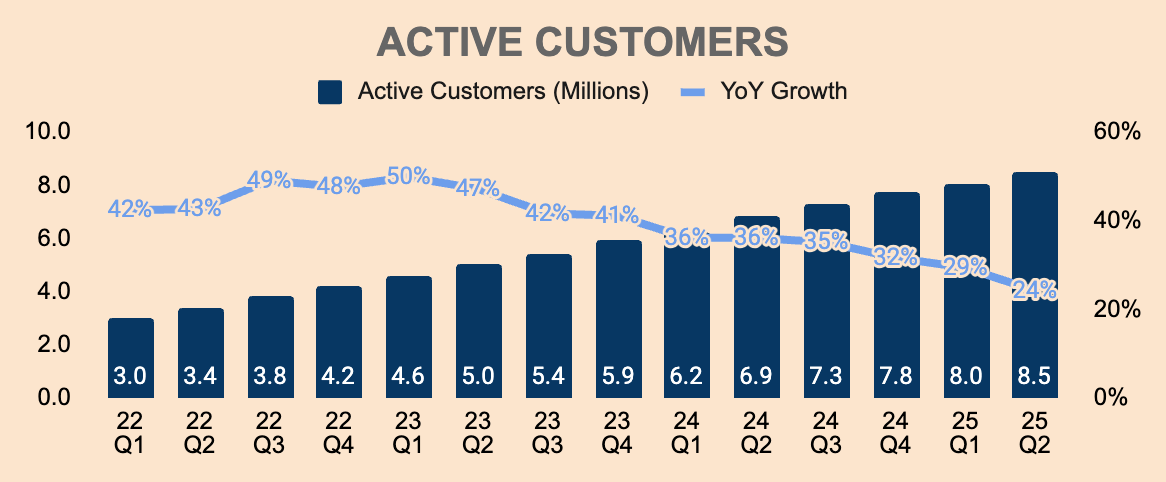

As you can see, RELY has grown its customer base at a rapid clip.

As of Q2, RELY has 8.5M Active Customers, which has more than quadrupled since the beginning of 2021. While growth has been extremely strong over the last few years, we can see that growth has slowed down considerably in recent quarters.

In Q2, Active Customers grew by 24%, which may be its lowest growth rate to date. The growth slowdown is reasonable given that the company is growing over a larger base.

In addition, RELY has pared back marketing spend as management focuses on profitable growth. As a reference, Marketing Expenses were up only 10% YoY in Q2, as compared to 44% YoY growth in the same quarter last year.

Nevertheless, despite the moderation in marketing spend, RELY added 476K New Customers on a sequential basis, which is the third highest in a single quarter.

Whatever it is, the number of Active Customers continues to increase with each passing quarter, reflecting ongoing market penetration.

I consider customer growth to be one of the most important metrics to track, as it is a leading indicator of future sales and earnings growth, so it’s encouraging to see RELY continuing to grow its customer base.

That said, here’s something interesting.

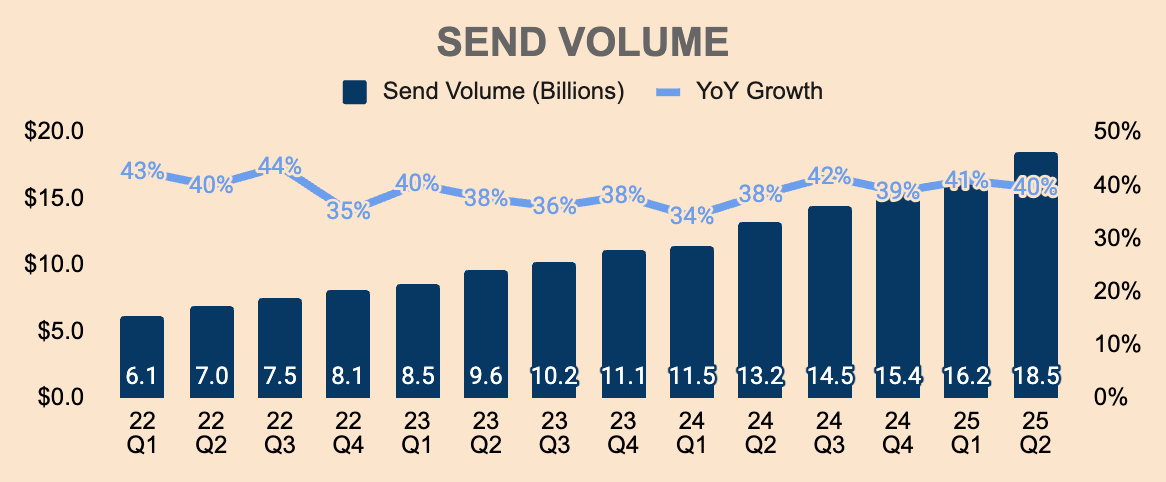

Send Volume, or the aggregate amount of money sent by customers, was $18.5B in Q2, up 40% YoY! As you can see below, Send Volume growth barely slowed down.

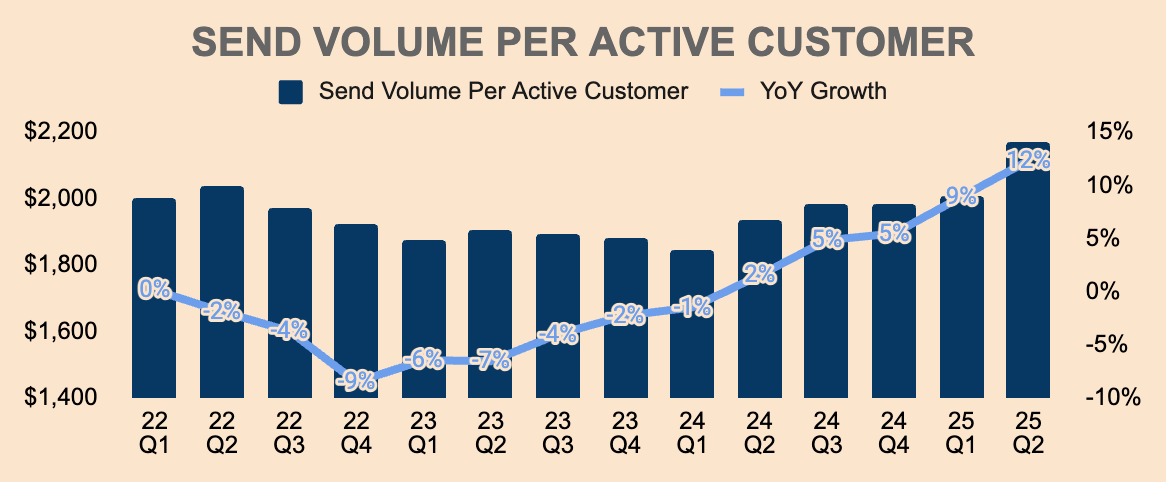

If you haven’t noticed, volume growth is significantly higher than customer growth. It could only mean one thing: customers, on average, are sending more money than ever.

As shown below, Send Volume Per Active Customer is the highest it has ever been, at $2,171 in Q2, up 12% YoY. This was driven by increased transactions per Active Customer, growth in micro business customers, and higher send limits in key corridors.

Notably, Send Volume for transactions of more than $1,000 grew more than 45% YoY, indicating strong traction among high-amount senders.

As we noted last quarter, high amount senders is a key area of strategic focus for us. Using AI, we are able to reduce friction and enable higher send amounts without compromising compliance. Combined with our deep partner integrations, we have raised transaction limits significantly and streamlined the experience end to end. This has led to a record year-over-year Send Volume growth of over 45%, for customers sending more than $1,000 and the volume mix from these customers increased by 300 basis points year over year.

(CFO Vikas Mehta — RELY Q2 2025 Earnings Call)

Higher Send Volume Per Active Customer points to increased brand trust and improved monetization. And given that high-value senders — whether it be individuals or businesses — are a new category for RELY, management plans to accelerate marketing investments to attract and retain this valuable cohort, so expect robust volume and volume per customer growth from here on.

We’ll increase our marketing investments over the next 6 to 12 months to support initiatives around high amount centers, micro businesses, and membership. We will make these investments while prioritizing efficiency. Our LTV to CAC was about 6x in Q2, while our payback period remained under 12 months. As a reminder, our marketing investments drive returns for many years beyond our initial investment given repeat behavior.

(CFO Vikas Mehta — RELY Q2 2025 Earnings Call)

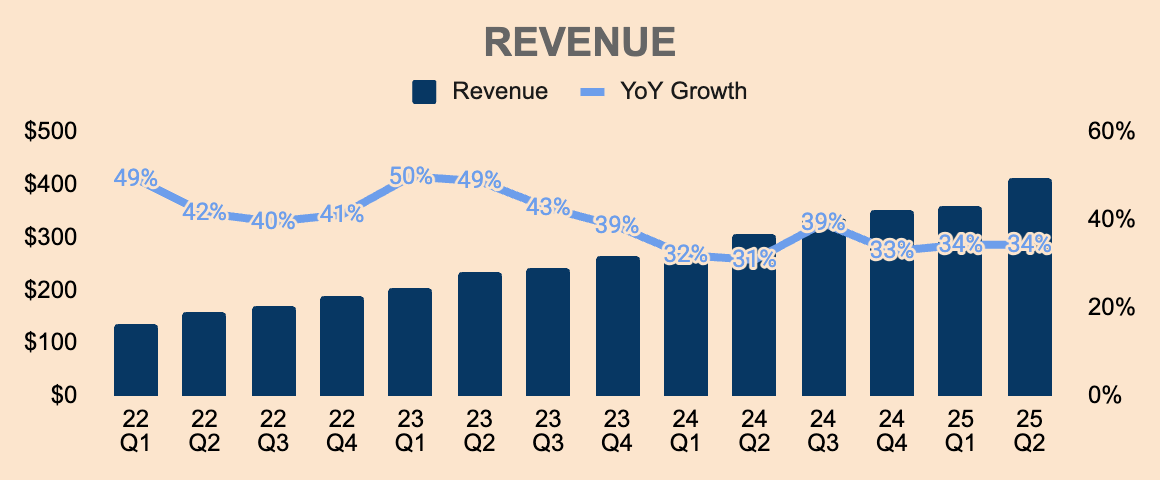

That said, strong customer and volume growth resulted in substantial sales growth for the company.

RELY generates Revenue through transaction fees charged to customers and the foreign exchange spreads on the amounts they send.

Transaction fees depend on the corridor, currency, funding method (e.g., ACH, credit/debit card), disbursement method (e.g., bank deposit, mobile wallet, cash pick-up), and amount sent.

Foreign exchange spreads represent the difference between the exchange rate offered to customers and the exchange rate on RELY’s currency purchases. This spread is set by RELY’s dynamic, proprietary algorithm.

In Q2, Revenue was a record $412M, up 34% YoY. This beat management’s guidance by $28M and analyst estimates by $27M, blowing past everyone’s expectations — a testament to management’s strong execution and the company’s incredible growth momentum.

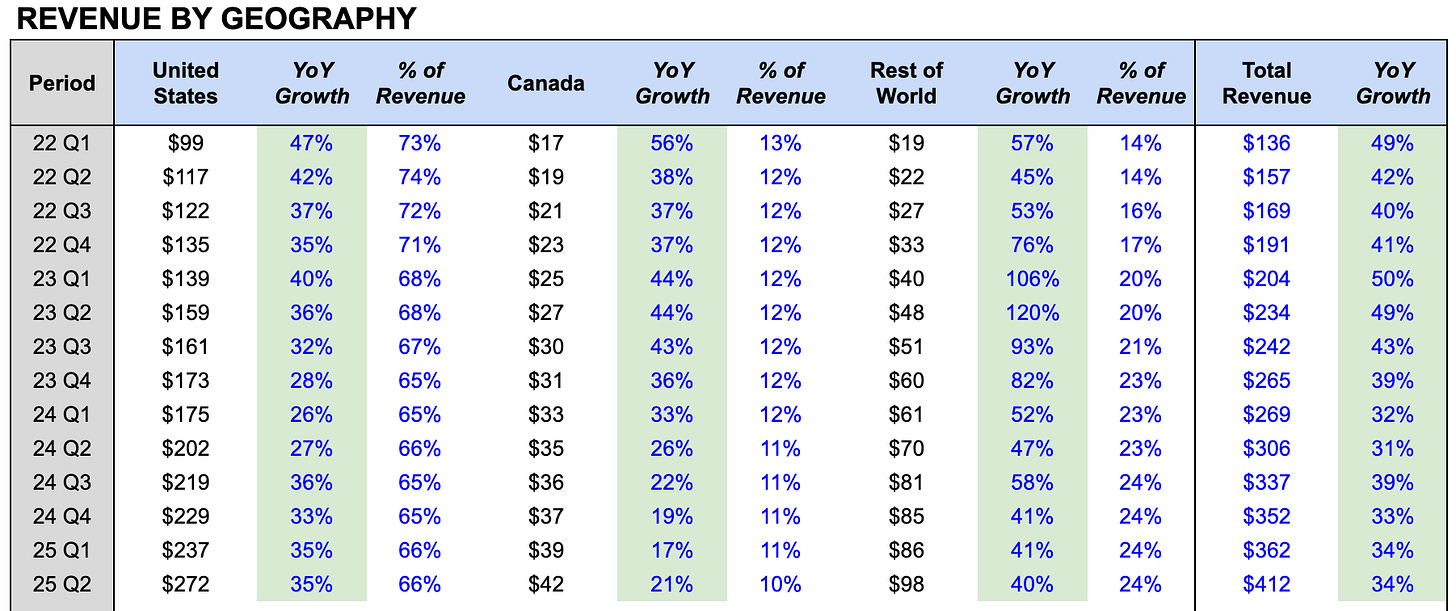

Breaking it down by geography, we can see that the United States and Canada are the two most mature markets for RELY, accounting for 76% of total Revenue in Q2. This means that the majority of RELY’s customers (the senders) reside in the US and Canada.

The largest receiving countries include India, Mexico, and the Philippines.

While North America is RELY’s largest market, more people outside of North America are beginning to use RELY’s financial services, as seen by the stronger growth rates in its Rest of World segment.

We should see the Rest of World segment becoming a much larger part of the business — perhaps, to 30% or 40% of Revenue — as RELY continues to diversify geographically.

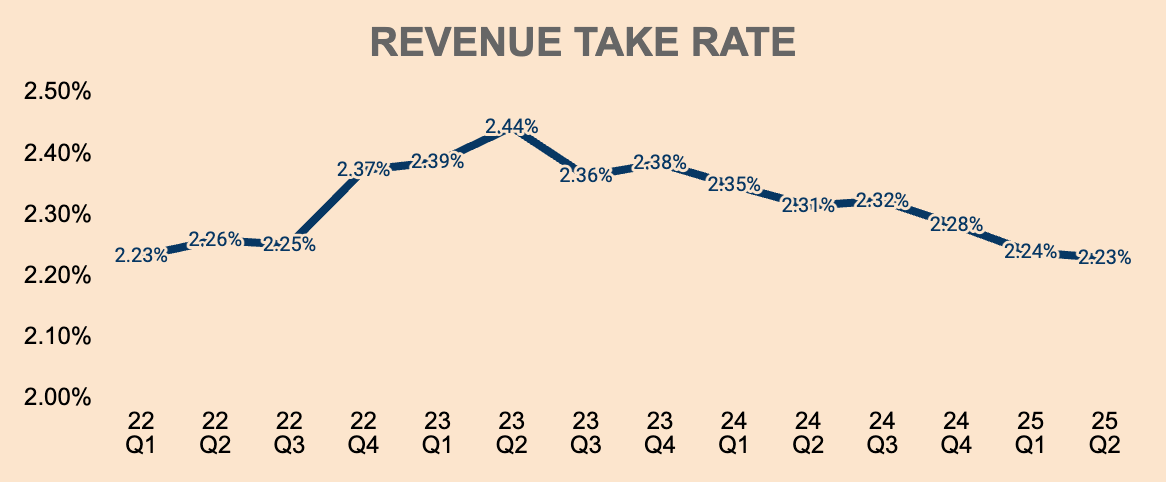

Something important to take note of: Revenue grew more slowly than Send Volume (34% vs 40%). One major reason for this is lower Take Rates, as measured by Revenue divided by Send Volume.

As of Q2, RELY’s Take Rate was 2.23%, down from its peak of 2.44%.

There are two reasons for the decline:

Increased customer promotions, which are accounted for as reductions to Revenue. RELY mainly uses promotions to stimulate first-time customer registrations and transactions. This usually involves waiving transaction fees or offering special foreign exchange rates.

The growth of higher transaction sizes, particularly from high-amount senders and microbusiness customers, is likely to compress Take Rates. Think about it: one $10,000 transaction with a $1.99 flat fee generates lower Revenue compared to ten $1,000 transactions with a $1.99 flat fee. Although both scenarios deliver $10,000 of Send Volume each, the former collected $1.99 of fee Revenue while the latter generated nearly $20 of fee Revenue.

Having said that, we can expect its Take Rate to decline further from here as RELY leverages customer promotions to incentivize high-amount senders and microbusinesses to join the platform.

While declining Take Rates are not ideal, I believe it’s more important to focus on Active Customer and Send Volume growth. After all, they are the leading indicators of future earnings growth, so sacrificing Take Rates in the short-term to maximize long-term earnings potential is the right way to go.

Fortunately, RELY has done an excellent job in growing its topline numbers.

This should lead to explosive earnings growth for years to come.

Profitability

Gross Profit — or as management likes to refer, Revenue Less Transaction Expenses (RLTE) — was a record $268M in Q2, up 35% YoY.

Gross Margin was 65.1%, up 30bps YoY but down 130bps QoQ. While Gross Margin declined sequentially, the metric has significantly improved over a longer time frame, up 650bps since the start of 2022, reflecting economies of scale and higher earnings potential.

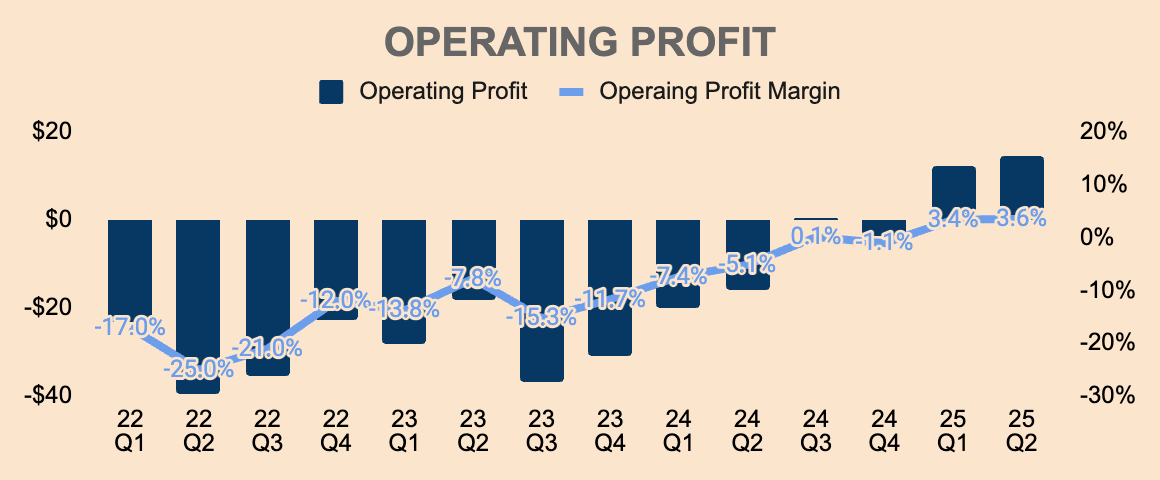

More impressively, RELY delivered a positive Operating Profit of $15M, up from $(16)M a year ago. Operating Margin was 3.6%, up 870bps YoY and 20bps QoQ, indicating strong operating leverage within the business.

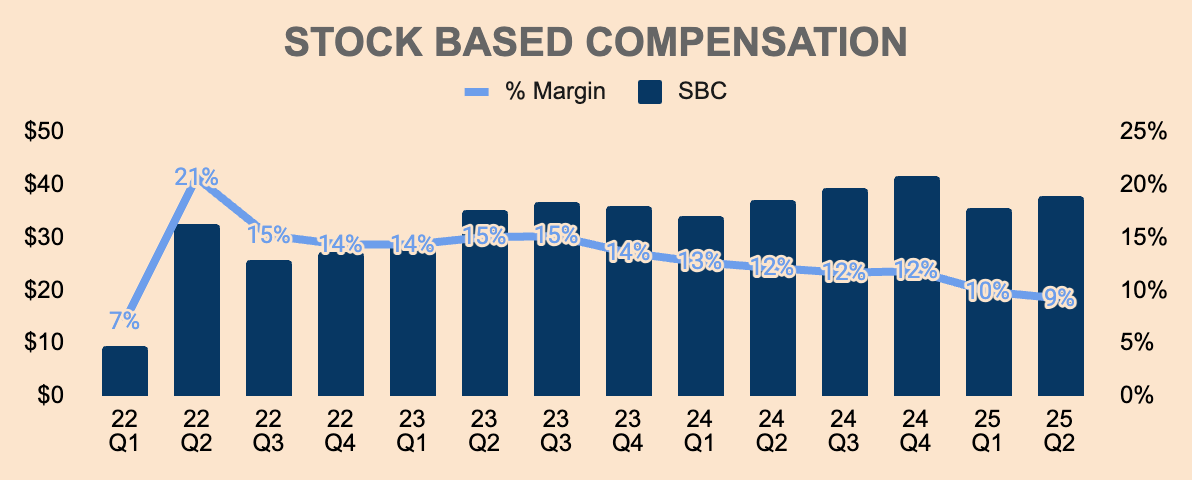

Stock-Based Compensation has remained stable ever since the company went public, keeping dilution under control. In Q2, SBC was $38M.

Encouragingly, SBC as a % of Revenue is trending down, now just 9% of Revenue.

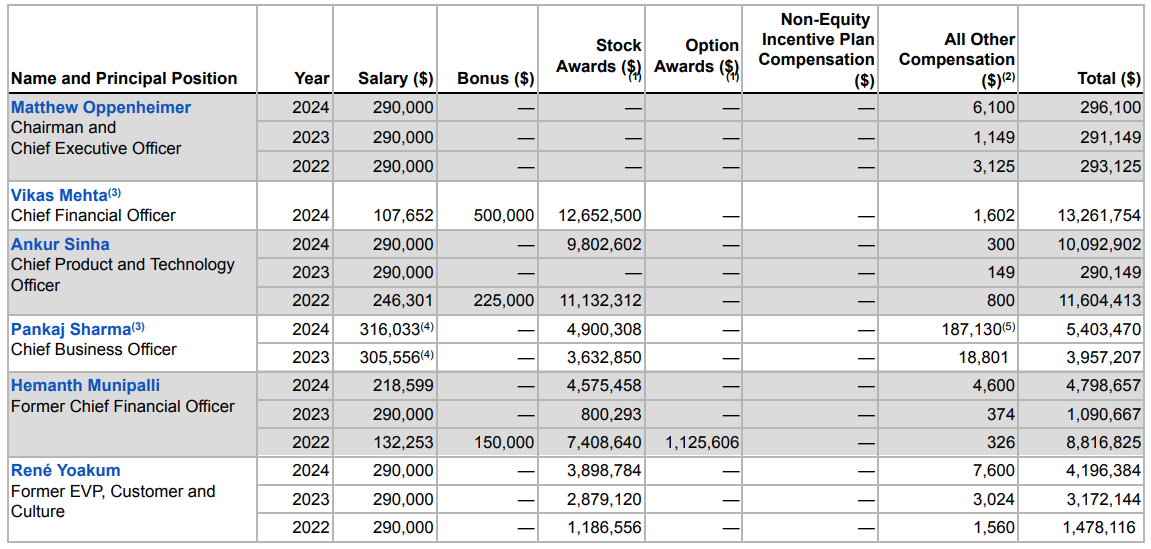

One thing I really like about CEO Matt Oppenheimer is that, despite taking on the most important role of the company, he is actually the lowest-paid executive in the company. As you can see in the table below, the CEO is only getting paid about $290K per year, while his associates are getting paid multi-million dollar figures.

A major reason for this wide discrepancy is that the CEO has chosen to forgo his stock awards in the last three years, thus bringing home only his annual cash salary of about $290K. Per the company’s annual proxy filing, he has also opted out of any equity award in 2025.

There are three things I can interpret from this:

The CEO cares about shareholder dilution — declining to be considered for an equity award means lower SBC and shares issued, thus minimizing dilution.

The CEO is aligned with shareholder interests — the CEO currently owns about 2.2% of the company, so the only way for him to “increase” his compensation is to increase the company’s stock price, which, at the end of the day, is what investors really want.

The CEO is confident about the company's future — if he didn’t believe in the long-term prospects of the business, he wouldn’t sacrifice millions of dollars in compensation in the short term.

All in all, I really appreciate the CEO for doing this. He didn’t have to. If anything, he deserves every bit of compensation for leading the company to where it is today.

Just look at the growth. Just look at the margin improvement. Just look at the company’s execution.

Nevertheless, I expect profitability to continue to improve from here, driven by continued operating leverage.

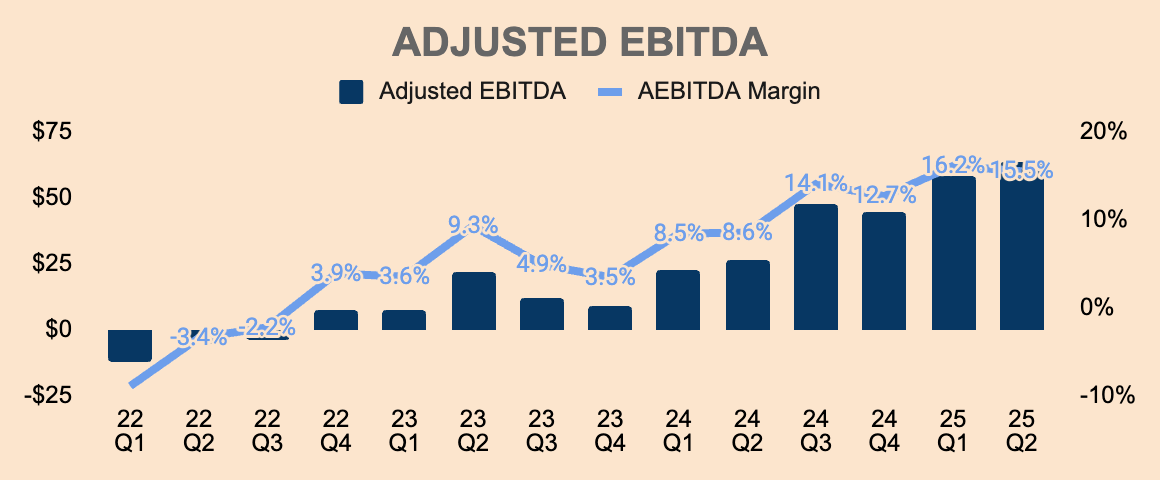

If we add back SBC and other non-cash items, we can see that Adjusted EBITDA has been in a consistent upward trajectory. In Q2, Adjusted EBITDA was $64M at a 15.5% Margin, which expanded 690bps YoY.

I expect this trend to continue, eventually reaching Adjusted EBITDA Margins of at least 20% within the next couple of years.

As such, I also expect an explosion in earnings in the coming years.

And by the way, the company is already profitable on a GAAP basis.

And with a Rule of 50 (34% Revenue growth + 16% Adjusted EBITDA Margin), RELY belongs in the rare breed of high growth and strong profitability, a testament to the durability of its business model and sustainability of its competitive moats.

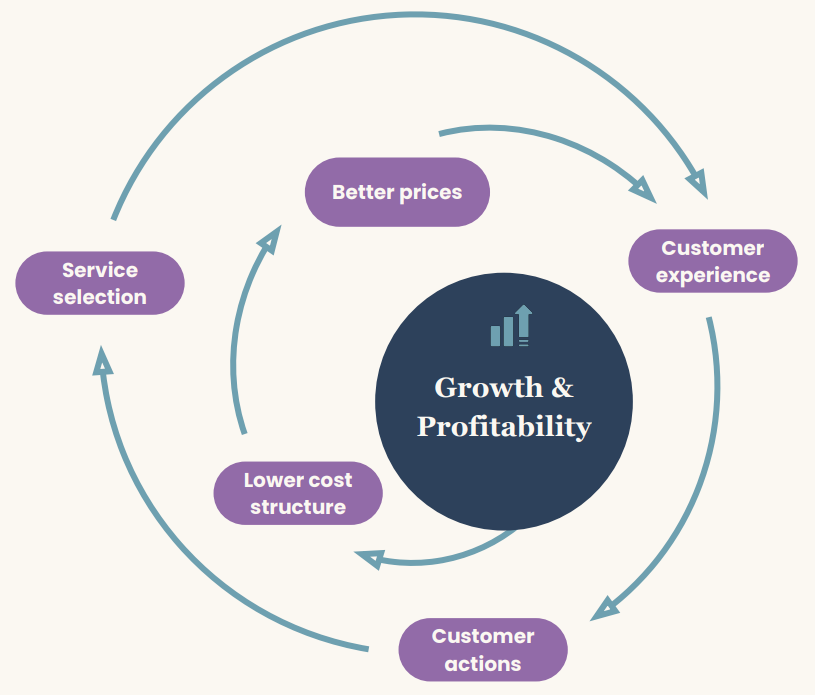

Considering its strong and improving fundamentals, RELY is in better shape than ever to reinvest in its platform, offering better prices, customer experiences, and new products.

In turn, this should drive more customers, transactions, and volume, ultimately producing a flywheel effect that should result in exponential earnings growth.

Health

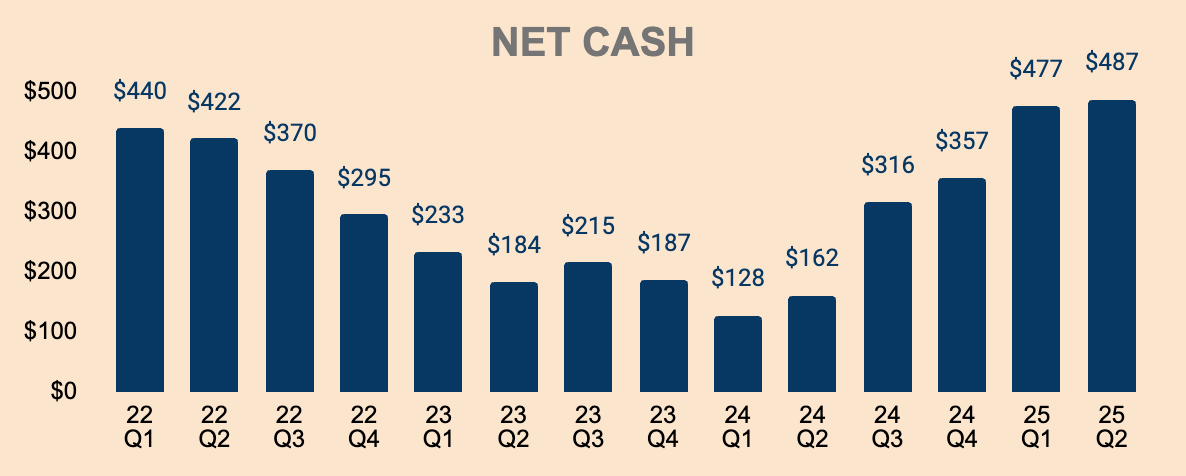

Turning to the balance sheet, RELY has $487M of Net Cash in hand, comprising $516M of Cash and $29M of Total Debt.

As you can see, Net Cash has trended down in 2022 and 2023. There are three reasons for this:

In 2022 and 2023, Operating Cash Flow has been largely negative, thus causing a decline in Net Cash.

In Q1 2023, RELY acquired Rewire for a total consideration of $78M, of which $56M was paid in cash.

During peak periods and weekends, RELY tends to tap its Revolving Credit Facility to support the surge in customer transaction volumes. This increases Total Debt, which drags Net Cash levels down. However, it’s important to note that the average term of outstanding borrowings under its Revolving Credit Facility is only four days, so RELY does not hold this extra debt for long, and instead, repays its debt as soon as the company collects Revenue from its customers. Just take note that, depending on when these peak periods occur and when the quarter ends, debt levels may spike from time to time. Worry not, as this is actually a strong signal of customer demand.

So far this year, RELY has drawn and repaid $2.5B against its Revolving Credit Facility. As of Q2, RELY has no outstanding borrowings under this facility.

With that being said, notice how Net Cash has been growing since the beginning of 2024. This is mainly due to positive cash flows over the last few quarters.

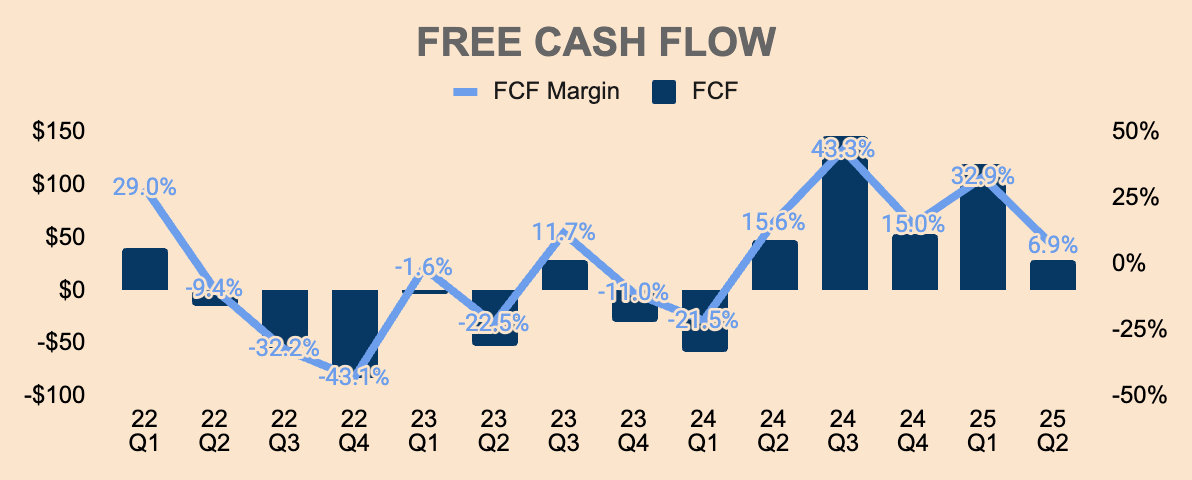

In Q2, Free Cash Flow was $29M at a 6.9% Margin. Although FCF has turned positive, it has been quite volatile and unpredictable. Similar to its Net Cash position, FCF is also impacted by the timing of customer transactions.

Our changes in operating cash flows are heavily impacted by the timing of customer transactions and, in particular, the day of the week that the quarter end falls on, including holidays and long weekends. For example, we generally have higher prefunding amounts if the quarter closes on a weekend or in advance of a long weekend, such as a holiday, which creates variability in customer transaction-related balances period over period and can reduce our cash position at a particular point in time.

(RELY 2024 10-K)

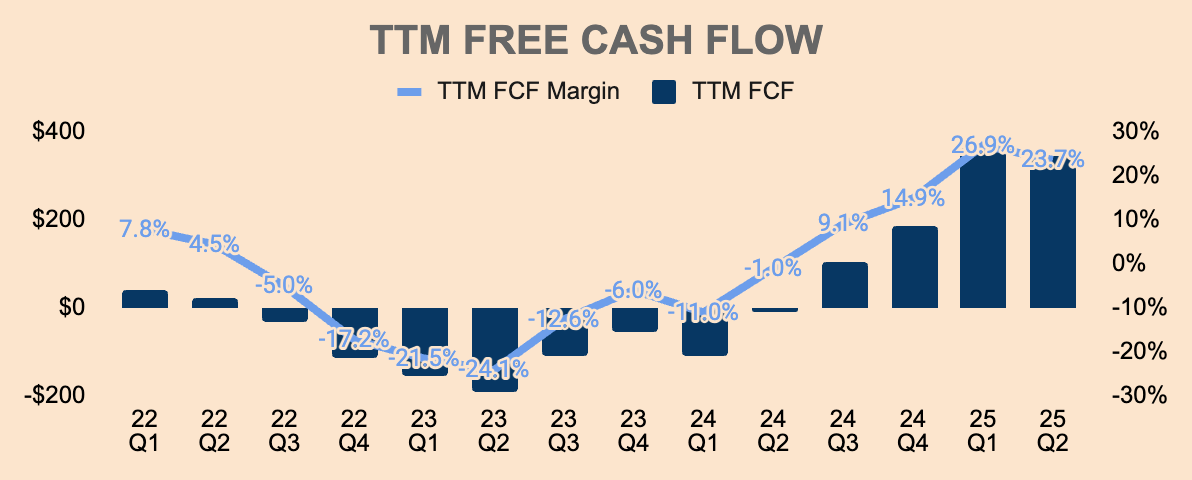

To remove the timing impacts of customer transactions, I like to look at FCF on a TTM basis. It better reflects RELY’s true FCF profile.

As you can see, RELY’s has turned from a hopeless cash burner to a full-fledged cash generator.

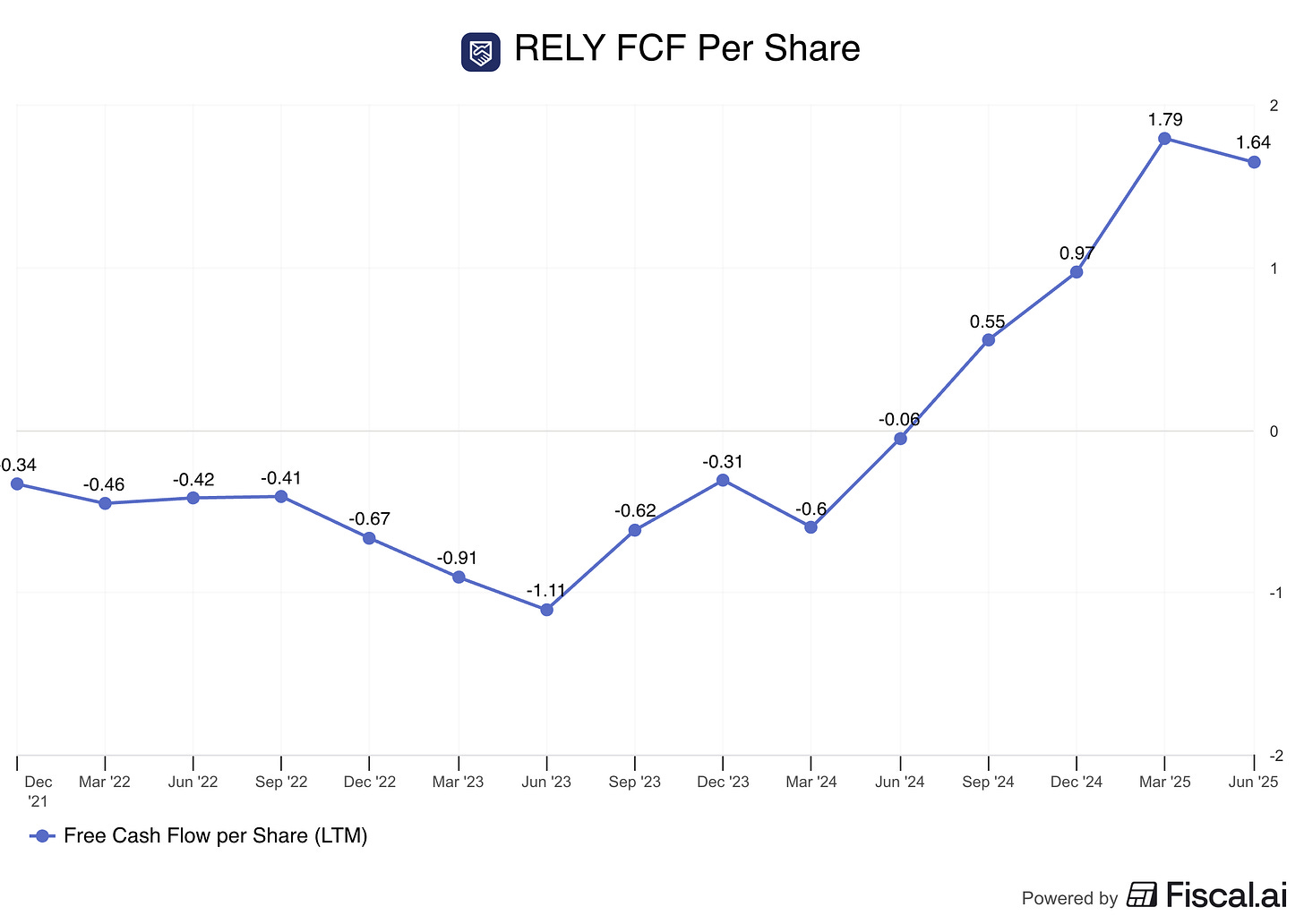

In Q2, TTM FCF was $346M at a 23.7% Margin, which expanded 2,470bps YoY. Despite the strong improvement in FCF Margin, I believe we’ll see minimal margin improvement from here.

For context, its main competitor, Wise, reported a FCF Margin of 23.5% and 27.5% during its fiscal year 2024 and 2025, respectively. Because of this, I believe RELY’s FCF Margin will stabilize at current levels.

Nevertheless, expect FCF, on an absolute basis, to grow from here, driven by sustained topline growth.

In Q2, management has authorized a $200M buyback program. Considering its positive Net Cash position, improved FCF profile, and depressed stock valuation (more on this later), I expect RELY to aggressively buy back shares in the next few quarters, thus accelerating FCF Per Share growth.

Outlook

Here’s what management guided for the rest of the year.

Q3 Revenue: $413M, up 23% YoY.

Q3 Adjusted EBITDA: $55M at a 13.3% Margin.

2025 Revenue: $1.62B, up 28% YoY. This guidance was raised by $33M.

2025 Adjusted EBITDA: $230M at a 14.2% Margin. This guidance was raised by $20M.

Per management, they are expecting tough YoY comps in the back half of the year, which is why growth is expected to slow down materially, dropping below 30% for the first time ever.

Consistent with recent trends, management expects Send Volume growth to outpace Revenue growth, and Revenue growth to outpace Active Customer growth. In addition, they expect Send Volume Per Active Customer to grow by mid-single digits, driven by high-amount senders and micro businesses.

Nonetheless, I expect RELY to destroy its guidance — as it always has. If you’re unaware, I’ve only included the high-end of its guidance, as RELY tends to outperform them.

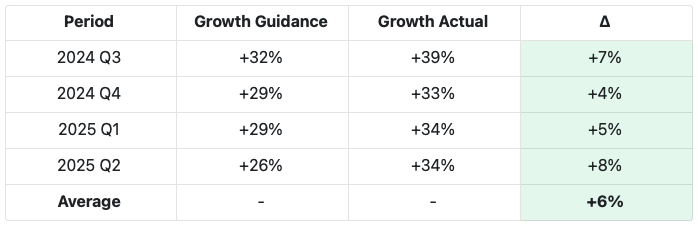

Below, I’ve included the high-end of management’s growth guidance and actual performance in the last four quarters. As you can see, RELY has outperformed its guidance by an average of 6pp.

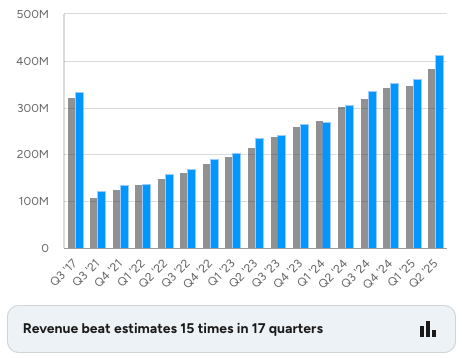

Moreover, RELY has a strong track record of beating analyst estimates — 14 beats in the last 16 quarters (ignore the first bar, RELY never reported Q3 2017 results).

Considering management’s execution prowess, I wouldn’t be surprised if RELY ends up outperforming guidance by 5% this year.

In any case, RELY still has a massive growth runway ahead. As management points out, RELY is “a growth company with no shortage of growth opportunities, and that’s a very fun business to run”.

For one, personal cross-border payment is a $2.0T market and is expected to reach $3.1T by 2032. As of Q2, RELY had captured approximately 3% of this market.

Put simply, RELY is still a speck of dust in the remittance universe.

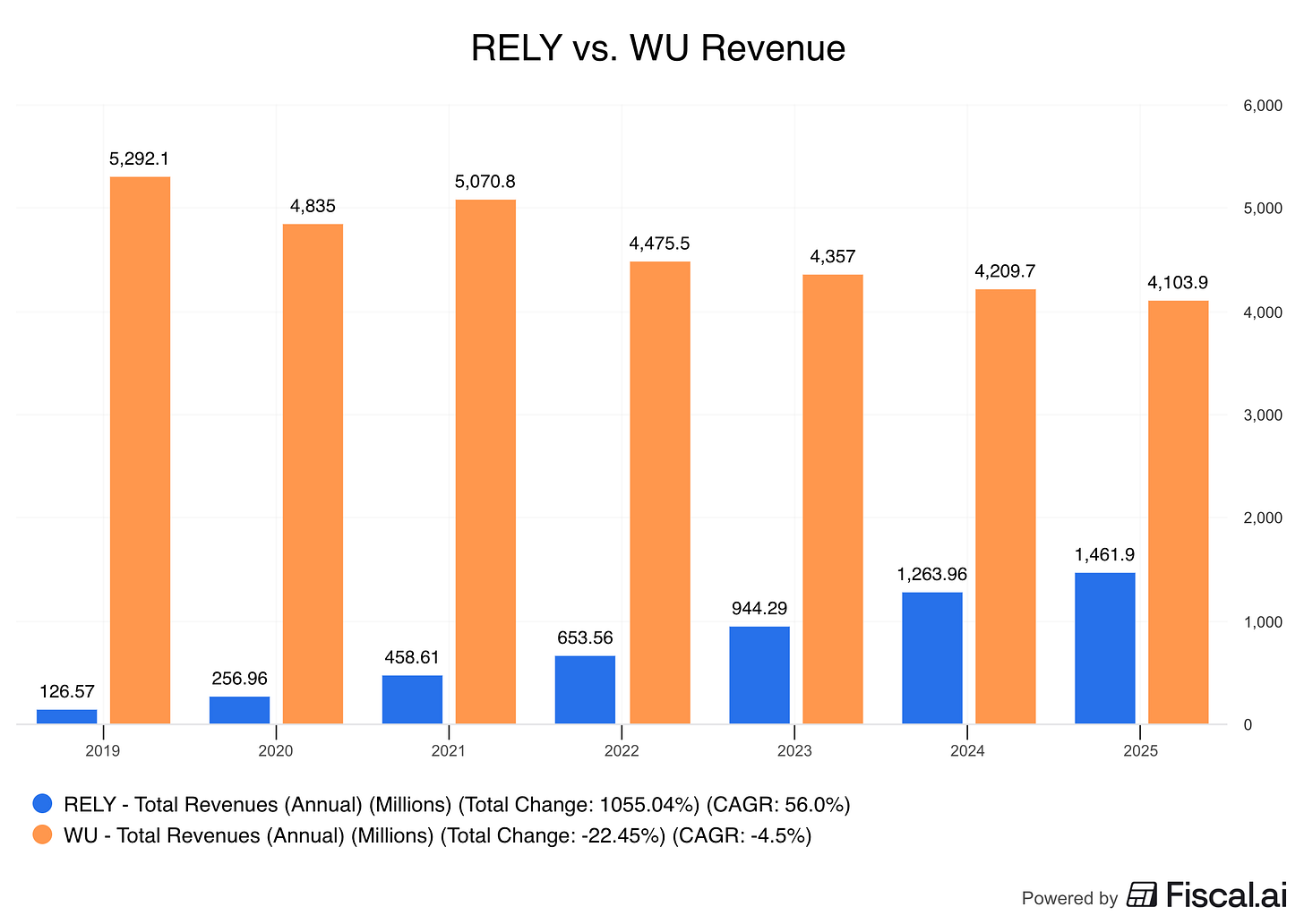

A surefire way for RELY to expand market share is by taking share from an existing player. For instance, The Western Union processed $103B of cross-border volume in 2024, which was up only 1% YoY. I believe growth will eventually turn negative, as customers turn to cheaper, more convenient alternatives like RELY and Wise.

Ultimately, The Western Union’s decline will add more fuel to RELY’s rise — the incumbent’s Revenue is RELY’s opportunity. As you can see, The Western Union’s Revenue has been on a gradual decline while RELY’s Revenue continues to ramp higher. This convergence will likely continue over the next decade until one day, RELY becomes the bigger company.

It’s just bound to happen.

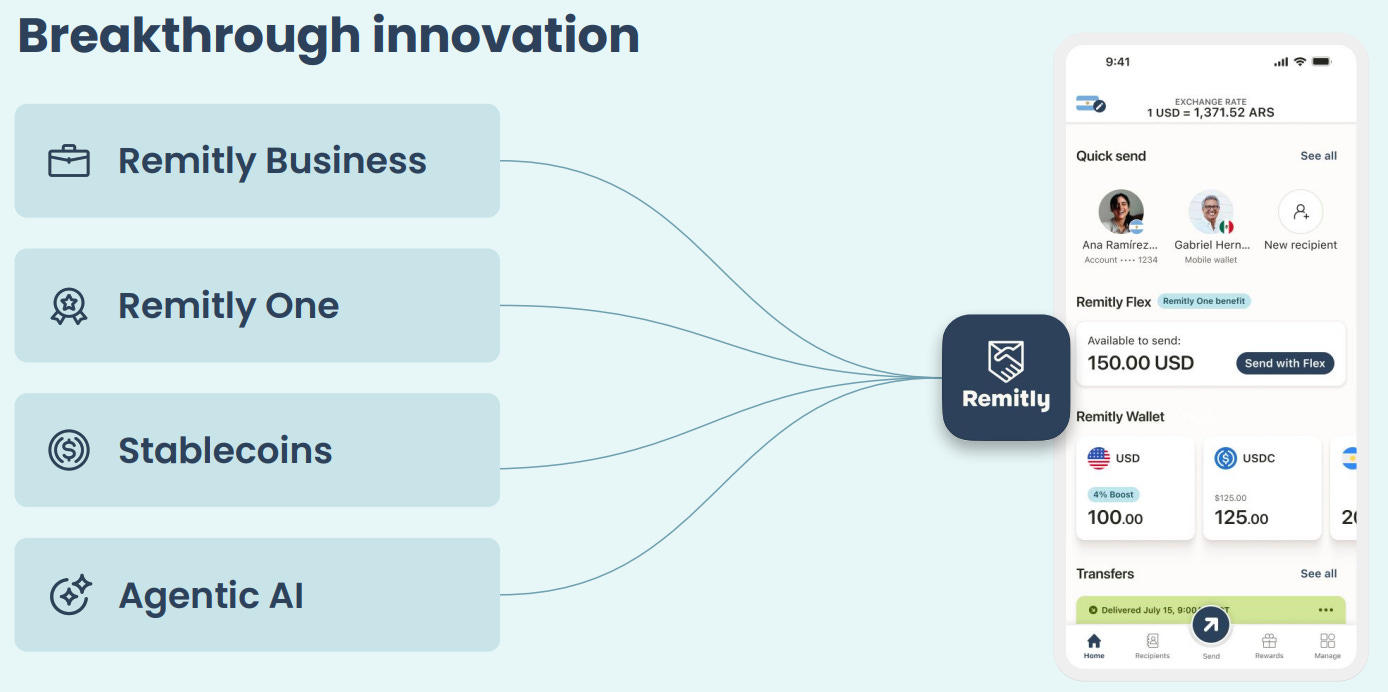

Aside from taking market share from incumbents, RELY’s recent product innovation also sets the company well for long-term, durable growth:

Remitly Business

I think the markets have yet to realize the potential of RELY’s expansion to SMBs. Remitly Business just launched in the US in Q2 and in the UK in August. Canada is expected to go live in Q4.

The business segment benefits RELY in three ways:

Expands its TAM from $2T to $22T.

Increases Send Volume Per Active Customer — average transaction sizes are nearly double from those of core customers.

Generates 6x higher lifetime value than individual senders.

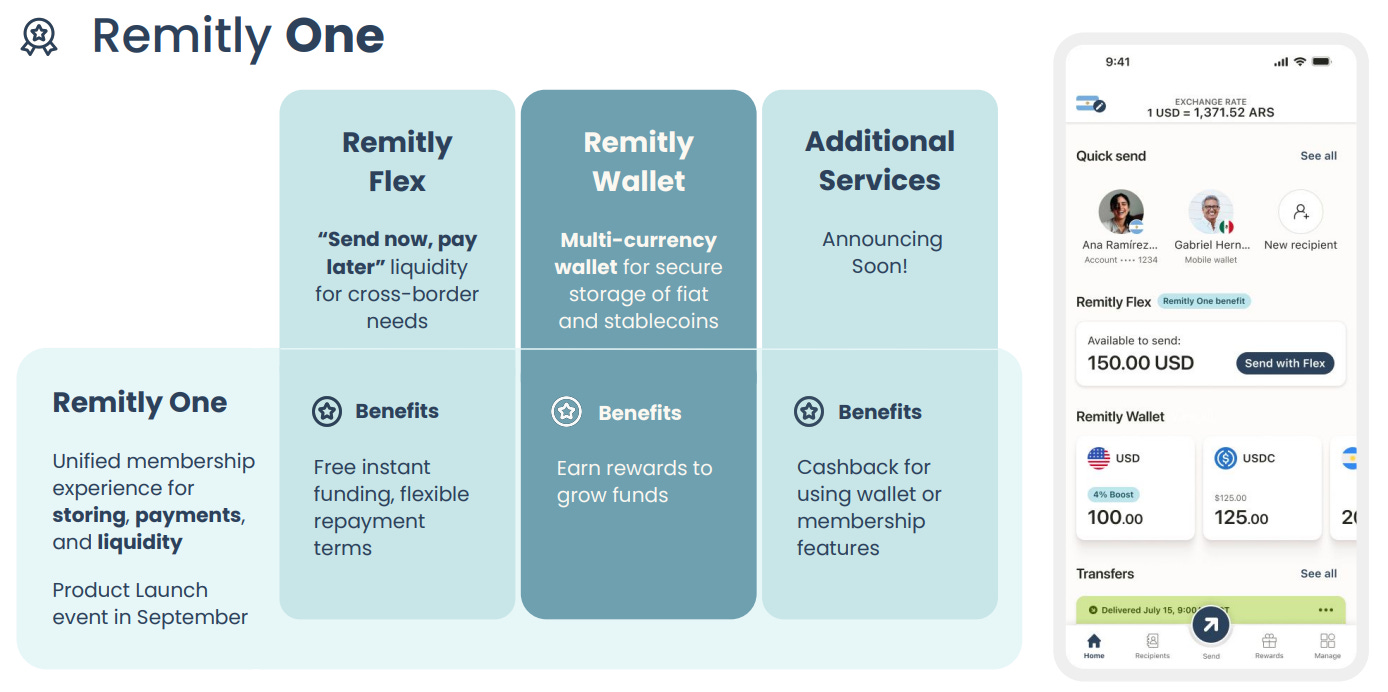

Remitly One

During the Remitly Reimagine product event, RELY launched various new products, including “send now, pay later” (Remitly Flex), a multi-currency wallet (Remitly Wallet), a digital debit card (Remitly Card), and more.

Remitly One — a membership program designed for cross-border payments — provides members with additional benefits as it relates to these new products.

For instance, Remitly One members have instant access to Remitly Flex while non-members have to wait for up to three days. In addition, Remitly One members get a 4% annual boost on USD balances stored in their Remitly Wallet, while nonmembers do not get any boost. Moreover, members get early access to the Remitly Card.

Members get these exclusive benefits for just $9.99/month.

For the company, the membership program is likely to drive stronger retention, higher engagement, and introduce a high-margin, stable Revenue stream.

Remitly One is the foundation of a new ecosystem, one where membership drives daily engagement, emotional loyalty, and long term financial growth. We will continue to add an expanding set of benefits, all designed for their lives when they need them most.

(CEO Matt Oppenheimer — RELY Q2 2025 Earnings Call)

Stablecoins

With the Remitly Wallet, members will be able to hold multiple currencies, including USDC stablecoins. The option to hold stablecoins will be particularly attractive for people who want to store their hard-earned money for future use, like education, a house, or retirement, but don’t want to see their savings lose value due to currency devaluation (e.g., Turkey, Argentina, or Zimbabwe).

Bears argue that stablecoins would be disruptive to RELY’s business model, but I think the adoption of stablecoins will be net bullish for RELY.

As I mentioned earlier, RELY has an intangible asset moat. It has the payment infrastructure, regulatory connections, and trusted brand to execute “the translation of fiat to stable, stable to stable, stable to fiat”, and disburse the funds to billions of bank accounts and mobile wallets, and hundreds of thousands of cash pickup locations.

That’s RELY’s competitive advantage. And with the launch of a global wallet — the Remitly Wallet — RELY will be well-positioned to capture the stablecoin opportunity.

When you think about the infrastructure that we’re building with the wallet, with Remitly One, and as we think about going into 2026 and beyond, we’ll also leverage stablecoins specifically to solve that customer pain point, which is holding a stable balance in emerging markets.

The reason Remitly can uniquely do that is because when you look, in my view, several years out of how the stablecoin journey will emerge, it is a valid store of savings. I think in most markets, and the world’s a big place, every regulator and every market will react differently. If you look at in most markets, there is still going to be the need to actually take that USDC or stablecoin balance and then be able to get it into a local currency or local account to be able to use it, whether that’s cash pickup, whether that’s bank accounts, whether that’s mobile wallets.

We are uniquely good at that last mile, that last step of being able to get it from a stablecoin balance into a local currency and local store of value that folks can actually be able to use.

That’s where we see ourselves being able to really drive adoption across the globe. Yes, the ambitions for the Remitly Wallet are very much global.

(CEO Matt Oppenheimer — Goldman Sachs Communacopia + Technology Conference 2025)

In addition, a digital global wallet — with the ability to manage multiple currencies and stablecoins — could disrupt traditional money changers, which is, in itself, an entire industry.

In my view, RELY, through the Remitly Wallet, will benefit immensely from the digitization of money changers.

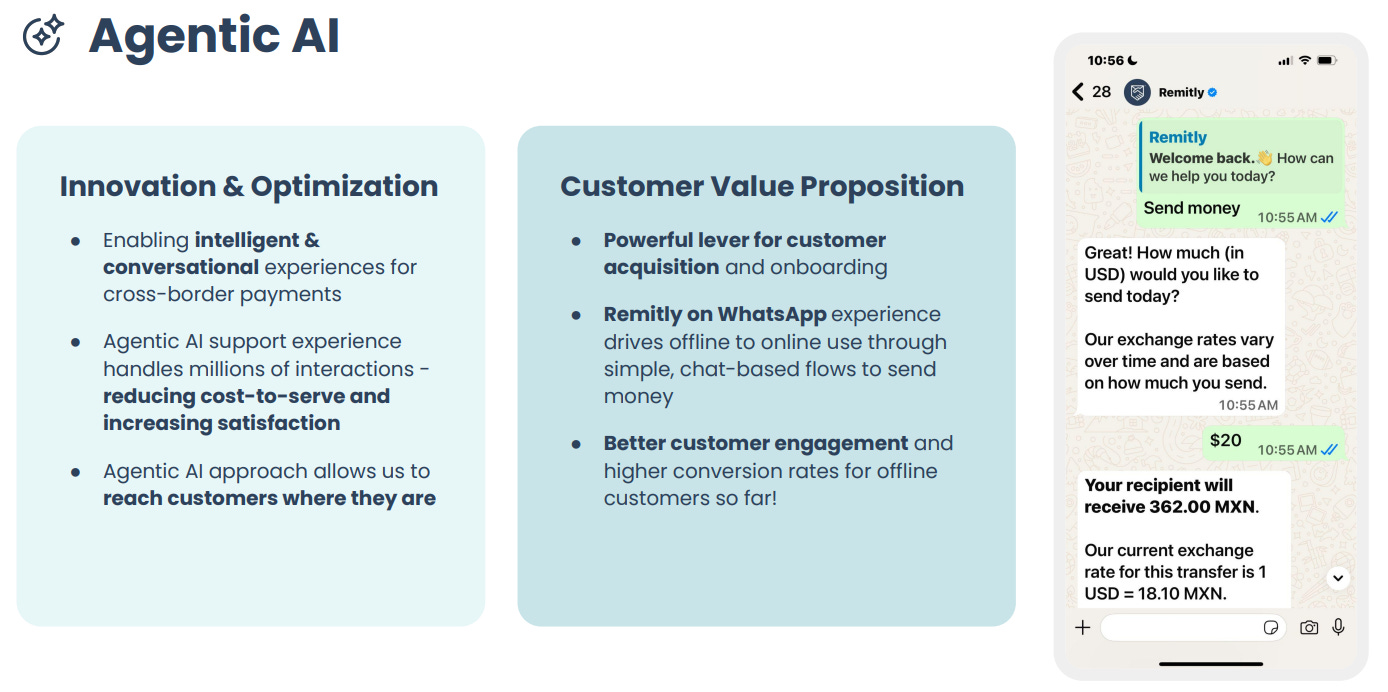

Agentic AI

RELY has been investing heavily in agentic AI as it aims to make digital financial services “intelligent, conversational, and personalized”.

Per management, the company is already rolling out AI agents into its daily operations:

Today, our agentic AI enabled support experience handles nearly 2M real-time interactions with customers, resolving issues, predicting intent, and adapting contextually, all while reducing cost to serve and increasing satisfaction.

(CEO Matt Oppenheimer — RELY Q2 2025 Earnings Call)

In April, the company announced Remitly on WhatsApp, allowing users to send money, check exchange rates, and track their transfers, all directly through WhatsApp.

In essence, deploying autonomous, intelligent agents within the RELY platform and other third-party platforms like WhatsApp enables seamless, conversational cross-border payment experiences.

With AI agents, RELY could scale even more efficiently, while delivering faster transactions and highly personalized customer experiences in the process.

Considering its current momentum and its new product launches in the last few months, I believe RELY will demolish all expectations in the near term.

The best part?

It’s not even baked into its valuations yet.

Valuation

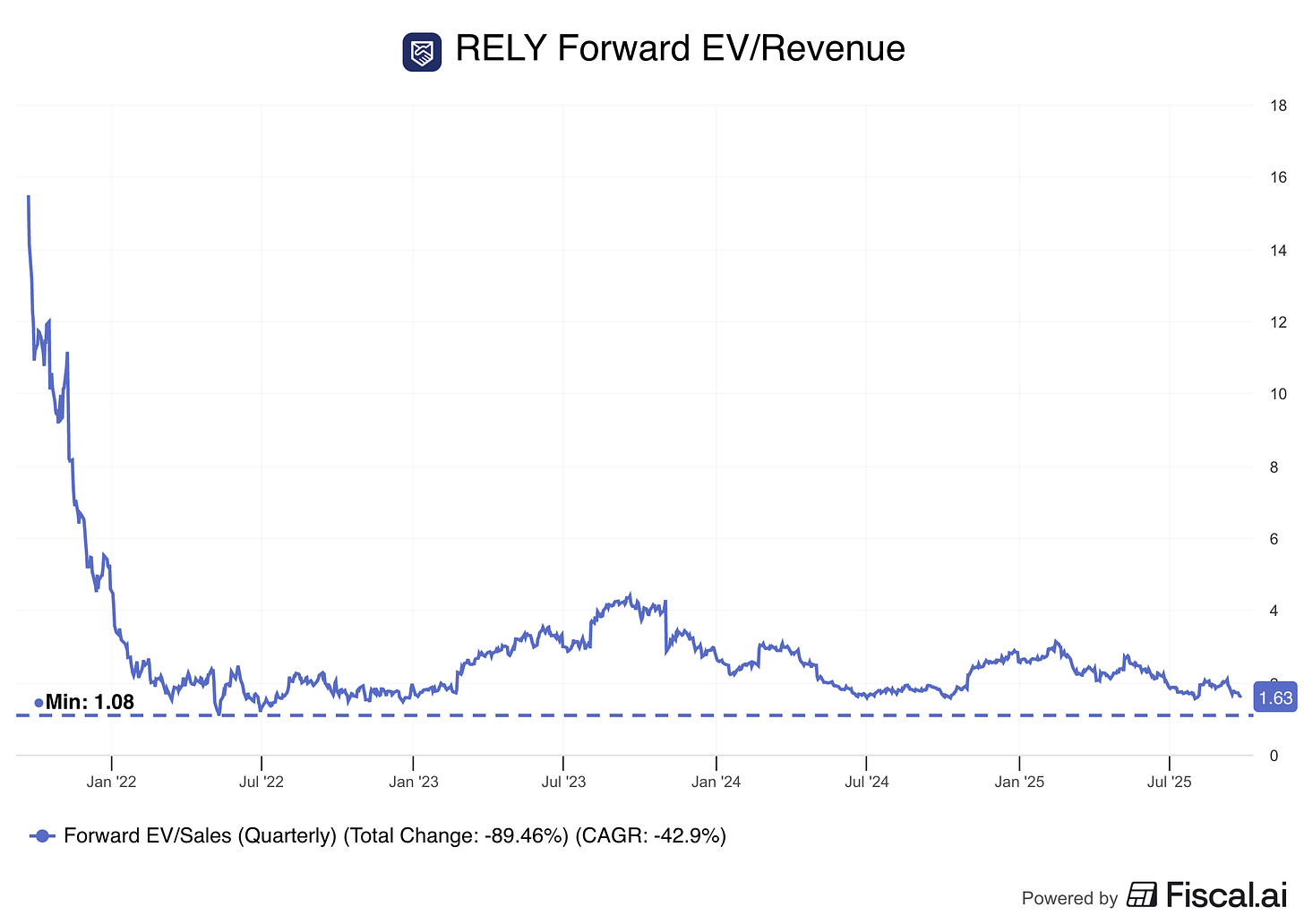

RELY is ridiculously cheap. Let me show you.

The company is trading at just 1.6x Forward EV/Revenue, which is near the bottom range of its historical multiple.

Let me remind you, RELY is:

Growing Send Volume at 40%.

Growing Active Customers at 24%.

Growing Revenue at 34%.

Already GAAP Profitable.

Producing robust FCF at a 23.7% Margin.

Has a Net Cash position of $0.5B.

Disrupting the traditional remittance industry.

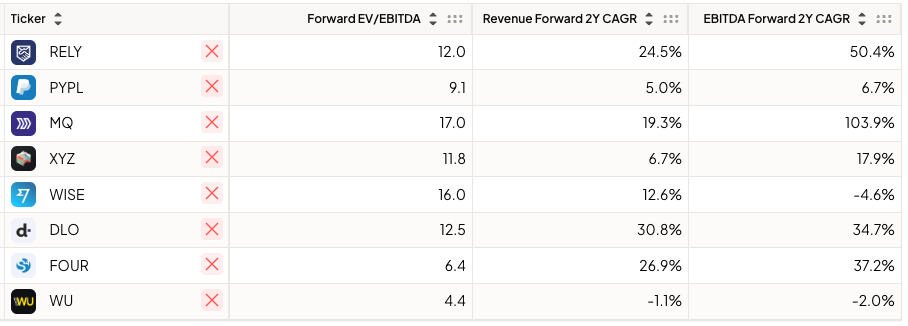

It also trades at just 12.0x Forward EV/EBITDA while expected to grow Revenue and EBITDA at a CAGR of 24.5% and 50.4%, respectively, over the next two years.

Below, I’ve listed some of RELY’s fintech peers. As you can see, RELY is one of the most attractively valued companies of the bunch.

For instance, if you look at PayPal (which I also own), it is valued at 9.1x Forward EV/EBITDA, which is slightly cheaper than RELY. However, RELY is expected to grow Revenue and EBITDA many times more than PayPal.

If we compare RELY with its main rival, Wise, we can see that Wise is valued higher than RELY, despite lower expected growth rates.

These are not apples-to-apples comparisons, of course.

But what I’m trying to point out is that RELY is very cheap considering its strong fundamentals.

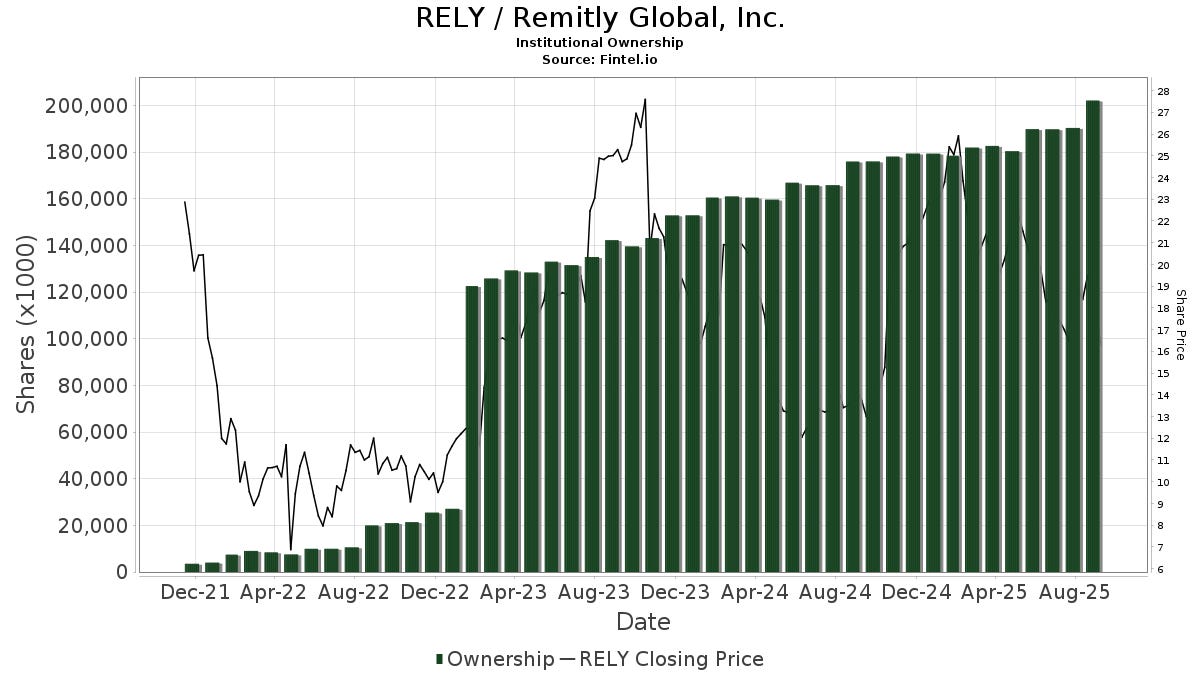

Perhaps that is why institutions are loading up on RELY. As you can see, institutional ownership is the highest it has ever been. Smart money must really like the stock.

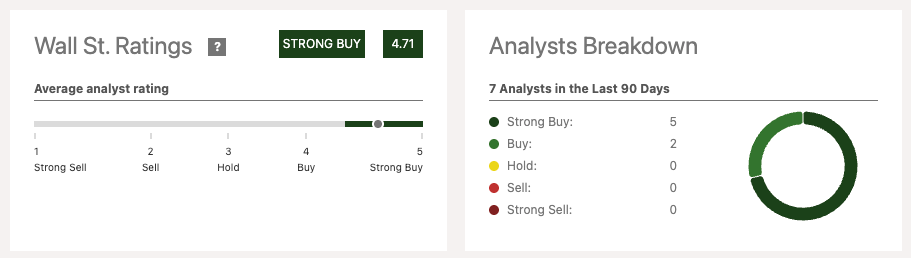

Analysts, too, are bullish on RELY — the company has 7 Buy ratings with zero Sell ratings.

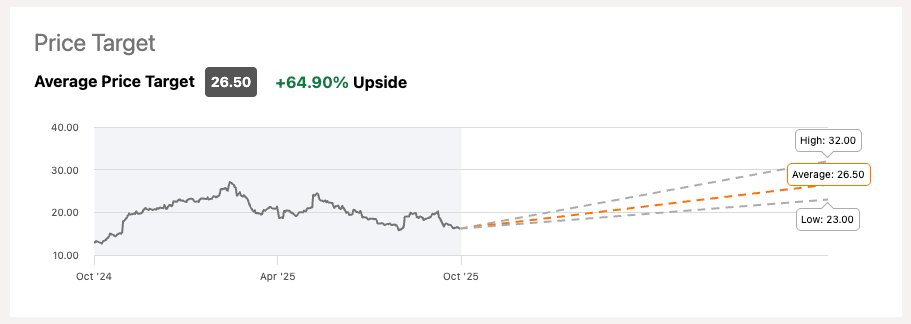

The average price target is $26.50, representing an upside potential of about 65%. The street low is $23, which is 40%+ higher than the current price of $16. On the other hand, the street high is $32, which is double from here.

Speaking of price targets, let me share mine with you…

The next few sections are available exclusively for paid subscribers:

My DCF model and price target

Risks

Thesis (and what I’m doing)

Keep reading with a 7-day free trial

Subscribe to RS Capital to keep reading this post and get 7 days of free access to the full post archives.